World steel plant maps - 2023 geography.

Steel Industry Maps

Plant locations in 2023

World coke plants

The chart illustrates the locations of ~400 metallurgical coke plants. Roughly 35% of the world's coke plants are to be found in China, with India (~10% of plants) the next most popular location. The largest facilities are to be found in Japan [JFE Steel, West Works Kurashiki and Fukuyama, each with ~4.5 mt/year coke capacity] with Poland's Zdieszowice plant notable also in terms of size [capacity of ~4.4 mt/year].

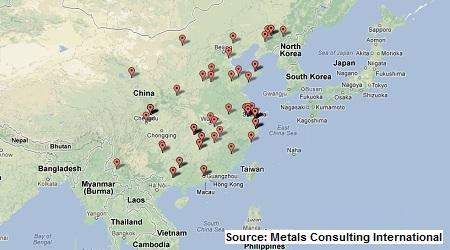

Chinese seamless tube plants

Approx ~64 seamless tube plants can be identified in China. The Tianjin Pipe Plant [capacity ~2.8 mt/year] appears to be amongst the largest of these facilities. Some plants however (including those of Changcheng Steel, Guangxi Liuzhou Iron & Steel, Guangzhou Iron & Steel Enterprise Group, Jiangsu Xigang, Tangshan Jianlong Industry, Kunming Iron & Steel Group, Bohai Drill Pipe, Fushun Special Steel and Yantai Steel) may not currently be operational.

European SBQ plants

There are ~53 producers of engineering steel (SBQ) bar in Europe [counting Europe as Western, Central and Eastern Europe but excluding Turkey]. The Metalloinvest Urals Steel SBQ plant at Stary Oskol [capacity ~1mt / year of engineering steel bar] is the largest of these plants, with the Mittal Ruhrort facility in Germany [SBQ capacity ~0.85 mt bar / year] in number two position. Ascometal's Le Cheylas facility was mothballed in 2011 and its present status is still uncertain.

Middle East direct reduction plants

There are ~33 producers of direct reduced iron in the Middle East. Of these, ~13 DRI facilities are in Iran [where capacity at Mobarakeh Steel dominates], 6 in Egypt and 5 in Saudi Arabia.

Integrated steel plants in Europe

There are ~55 locations across Eastern, Central & Western Europe with BOF steelmaking. Total liquid steel capacity at these locations in ~260 million metric tonnes production/year.

The three largest BOF production sites are Taranto Italy with ~13.6 mt/year, Cherepovets in Russia with ~12.7 mt and Temirtau in Kazakhstan with ~10.6 million tonnes of annual capacity.

Indian induction furnace locations

Induction furnaces were first installed in India to make stainless steel from imported scrap. Their use evolved in the early 1980s into production of mild steel, the popularity of the induction melting furnace being driven by relatively low capital and operating costs [compared to EAF steelmaking].

There are currently several hundred induction furnaces in India. Although their distribution around the country is fairly uniform, some ~20% of induction furnaces are based in each of the Maharashtra and Punjab states.

USA zinc coating lines [HDG & EGL]

We consider that there are ~48 zinc coating lines in the United States of America. The average capacity of these lines is ~550kt zinc coated coil or sheet / year. The largest facilities are the AK Steel plant at Middletown in southwest Ohio [capacity ~1.6 mt/year], the Severstal facility at Sparrows Point [Zn coating capacity ~1.4 mt/year] and US Steel's Midwest galvanising plant at Portage, Indiana [capacity 1.2 mt/year]. Contact us if you are interested in similar steel industry maps.

Welded tube producers in Central & Eastern Europe

There are ~50 producers of welded tube and pipe in Central and Eastern Europe. The larger producers include the Vyksa Metallurgical Works in Russia [part of the United Metallurgical Company or OMK Group] with ~3.3 mt / year welded pipe capacity; and the Khartsyzk Tube & Pipe Works in the Ukraine [owned by the Metinvest Group] with ~2.6 mt/year of production capacity.

Liquid steel melt shops in Japan

There are approx 115 producers of liquid steel in Japan. The three largest production sites are Kurashiki Mizushima which belongs to JFE Kawasaki Steel and has ~13 mt crude steel capacity; Fukuyama which belongs to JFE-NKK and has ~12mt capacity; and the NSSMC Nippon Steel plant at Kimitsu with ~11.7 mt crude steel production potential. The highest density of steel plants is in the Tokyo-Yokohama area which has 35 facilities; and in the Osaka-Nagoya region where there are 32 steel plants.

Looking for other steel industry maps?

We can plot out the geography of most plant types. Email us at info@steelonthenet.com or call us on +44 775 149 0885

© 2001 -

2024 Steelonthenet.com. All rights reserved.

To contact us about facility geography please email info@steelonthenet.com.

To contact us about facility geography please email info@steelonthenet.com.