Steel market outlook & forecasts.

Market Outlook - Forecasts - World Steel Prices

Year 2024+ Steel Price Projections

The note that follows considers near-term steel price forecasts - that is, the outlook for world steel prices in 2024 and beyond.

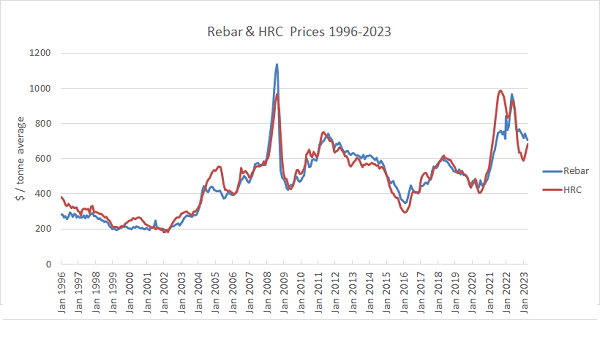

The price cycle - MCI viewA notable characteristic of world steel prices is that they are highly cyclical. As can be seen in the chart below, prices move from peak to trough every few years. Looking at pricing for typical steel products such as hot rolled coil (HRC) or reinforcing bar, the latest prominent peaks occurred in August 2011, April 2018 and September 2021; with price troughs occurring in May 2009, February 2016 and June 2020. Across these products, the average peak-to-peak or trough-to-trough time over the last 25 or so years works out at ~3-4 years. In our view, the next price peak can be expected around mid-2028. We also forecast that the next pricing trough will occur in mid-2024 or perhaps even mid-2025.

It is MCI's view that - at the time of writing (February 2024) - international steel prices appear to be declining, dropping from a September 2021 high. Other independent observations appear to agree with this view of the steel market outlook, as discussed below.

Near term steel prices - analyst viewLooking at the coming months, many analysts also consider that prices are currently on a falling trend.

- Fastmarkets recently commented that steel prices were unlikely to rally in the near term because of expected increases in capacity. See Fastmarkets analyst views

- According to Fitch, world prices of iron ore, coking coal and thermal coal will show continuing declines in the coming years. For more information, see The Fitch report.

- In an article dated 29th August 2023, Capital Economics predicted that prices would continue to decline in most major steel markets to the 2023 year-end. Only when economic growth recovered and interest rates fell in 2024 did their analysts expect prices to rise in Europe and in the USA. Capital Economics also predicted further price declines in China in 2024, based on weak demand growth and excess capacity.

Supply demand outlook

Another way to consider the pricing outlook is to consider future prospects for the global steel supply-demand balance. In this respect, it is noteworthy that:

- The World Steel Association (worldsteel) consider that global steel demand in 2024 will grow by 1.9% over 2023 levels (from ~1814 million tonnes in 2023, to ~1849 million tonnes). This is equivalent to a 2024 increase in steel consumption of ~35 million tonnes [See Worldsteel, Short Range Outlook October 2023].

- The OECD meanwhile [see OECD Developments in Steelmaking Capacity, 2023] reported that over the three year period 2023-2025, some 59.9 mt of gross capacity additions were currently underway; with a further 106 mt of capacity in the planning stage also likely to come on stream. This is equivalent to an increase in steel capacity of over ~55 million metric tonnes per year, a rate of increase that will easily surpass the anticipated rate of steel demand growth.

On this basis, we judge that year 2024 capacity utilisation is likely to fall below 2023 levels, leading to reductions in steel prices globally.

Market outlook and 2024-2025 steel price forecastsTaken together, MCI's judgement regarding the current level of steel prices in the context of the longer-term price cycle; with our assessment of expected changes to the steel supply demand balance in 2024; and our review of the near-term outlook for iron ore and coke prices – all point to a declining steel price to end-2023 and as year 2024 unfolds. The MCI projection therefore is that steel prices will gradually continue to fall in Q4 2023 and during year 2024, reaching a trough around mid-2024 or possibly even in 2025. After that point - especially as ETS allowances are fully withdrawn in Europe and as the cost impact of CBAM kicks in, steel prices are likely to resume their return to higher levels.

Recent updatesA December 2023 report from Oxford Economics predicted 2024 reductions in steel prices of ~7% both in the EU and in the USA; as well as further steel price reductions of of ~2% in the EU and of ~11% in the USA in 2025. See Oxford Economics 2024 metal price outlook report.

Other press reports dated early January 2024 confirm the view that global steel prices will remain subdued this year. This is because global steel demand remains weak, driven by lower consumption from manufacturing and construction in developed economies and because of ongoing weakness in China's property sector. Click here to read more about depressed 2024 steel prices, based on ocomments from the Australian Office of the Chief Economist and the research agency BMI (a unit of Fitch Solutions). Also, Eurometal noted on 21st February 2024 that European buyers of hot rolled steel coil were expecting further price drops in the coming weeks.

For MCI's projected monthly steel prices in H1 2024 and beyond, see our our steel price projections page.

Metals Consulting International Limited22nd February 2024

To contact us about the steel market outlook please email info@steelonthenet.com.