Steel Sector State Aid Support

Recent examples of government funding support

EU state aid rules allow competitiveness enhancing support to viable steel companies but do not allow public aid to steel manufacturers in financial difficulties. Nor do they allow government support that gives a steelmaker an advantage over its competitors (although aid for environmental protection or research and development is normally allowed). Regional aid and support for plant closure are also prohibited in the steel sector. The table below lists some examples where government support was considered and / or approved by the European Commission.

| Year | Country | Company | Facility | Project Type | Aid €m |

| 1994 | Portugal | Siderurgia Nacional | Seixal | BF closure, new EAF | 306 |

| 1995 | Austria | Voest Alpine Erzberg GmbH | Erzberg | Op losses & mine closure | 29.7 |

| 1996 | Ireland | Irish Steel | Haulbowline | Restructuring aid | 50 |

| 1998 | Bulgaria | Kremikovtsi Steel | Kremikovtsi Steel | Capex support | 222 |

| 2002 | Finland | Imatra | Imatra Steel Oy Ab | Environmental upgrade | 1 |

| 2003 | Romania | Mittal Steel | Petrotub | Debt forgiveness | 26 |

| 2006 | Belgium | Duferco | Wallonia-based firms | Share purchases | 211 |

| 2009 | Latvia | Liepajas Metalurgs | Liepajas | Loan guarantee | 89 |

| 2010 | Austria | Voestalpine Stahl | Linz | Clean up support | 146 |

| 2010 | Germany | Salzgitter | Flachstahl | Environmental protection | 19 |

| 2013 | Czech Republic | ArcelorMittal | Nova Hut | Environmental protection | 15 |

| 2015 | Italy | Ilva | Taranto | Loan subsidy plus capex | 2000 |

| 2021 | Poland | Jastrzebska Spolka Weglowa | JSK Koks | Capex support | 14 |

| 2021 | United Kingdom | Celsa | Cardiff | Energy efficiency | 3 |

| 2022 | Spain | Celsa | Celsa Spain | Business rescue | 550 |

| 2022 | Sweden | H2GS | Boden plant | Green steel | ECA g'tees |

| 2022 | Sweden | HYBRIT | Pilot plants | Green steel | 143 |

| 2023 | Belgium | ArcelorMittal | Ghent | Decarbonisation | 280 |

| 2023 | France | ArcelorMittal | Dunkirk | Decarbonisation | 850 |

| 2023 | Germany | ArcelorMittal | Duisburg | Decarbonisation | n/a |

| 2023 | Germany | ArcelorMittal | Hamburg | Demonstration plant | 55 |

| 2023 | Germany | Salzgitter | Salzgitter | Decarbonisation | 1000 |

| 2023 | Germany | Thyssenkrupp | Project tkH2Steel | Decarbonisation | 2000 |

| 2023 | Hungary | Dunaferr | Dunaferr | Employment costs | 42 |

| 2023 | Italy | Acciaierie d’Italia | DRI d’Italia | Pilot plant | 35 |

| 2023 | Poland | Jastrzebska Spolka Weglowa | JSW Plant | Energy cost support | 4 |

| 2023 | Slovakia | USSK | Kosice | Decarbonisation | 300 |

| 2023 | Slovenia | Slovenian Steel Group | SIJ Acroni | Energy costs | 1 |

| 2023 | Slovenia | Slovenian Steel Group | SIJ Metal Ravne | Energy costs | 1 |

| 2023 | Spain | ArcelorMittal | Gijon | Decarbonisation | 450 |

| 2023 | United Kingdom | Tata Steel | Port Talbot | Decarbonisation | 580 |

| 2024 | Germany | Stahl Holding Saar | Saarstahl and Dillinger | Decarbonisation | 2600 |

| 2024 | Germany | Vallourec | Pipe at Dusseldorf / Mulheim | Restructuring aid | 3 |

| 2024 | United Kingdom | British Steel | Scunthorpe & Teesside | Decarbonisation | 345 |

| 2025 | Germany | ArcelorMittal | Bremen and Eisenhüttenstadt | Decarbonisation | 1300 |

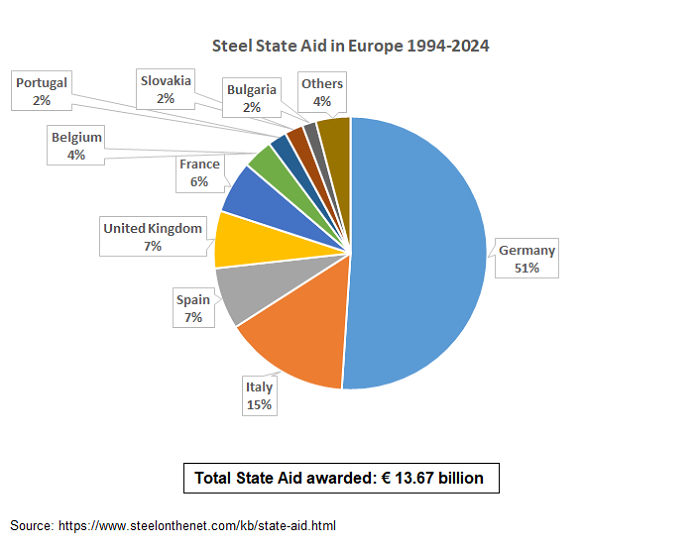

Analysis of Steel State Aid by Country

For analysis of European steel state aid by location of recipient plant [as at March 2024], see chart below.

Notes

- 1994: EC approval of Portuguese Government support for Siderurgia Nacional's blast furnace closure / EAF investment at Seixal was conditional on the workforce being reduced by 1798 employees by the end of 1996.

- 1995: Aid to Voest Alpine Erzberg comprised ATS 272m (Euro 19.8m) to cover operating losses [operating aid] plus ATS 136m (Euro 9.9m) for closure of iron ore mines in a safe and environmentally-friendly manner [closure aid], thus ATS 408m (Euro 29.7m) state aid in total.

- 1996: Aid to Irish Steel was equivalent to IEP 29 million. Calculation above assumes exchange rate of Euro 1.27 per Irish punt.

- 1998: Kremikovtsi went bankrupt in August 2008. The Bulgarian government then initiated proceedings to recover the aid, as part of the liquidation proceedings.

- 2003: Legality of the debt relief given to the Mittal Steel Roman seamless tube plant (Petrotub) was subsequently questioned by the European Commission in 2007.

- 2006: Wallonia firms involved in the 2006-2011 government support included Duferco Clabecq, Duferco La Louviere and Carsid. This aid was subsequently declared to have been illegal.

- 2013: Environmental support for ArcelorMittal Nova Hut in Ostrava in 2013 was for an upgrade of the sinter plant dedusting equipment. Distortion of competition because of this aid was expected to be limited.

- 2015: Government support to Ilva was subsequently challenged: the European Commission deemed that some of this aid had been illegal and in 2017 requested Ilva to repay €84 million of interest subsidy.

- 2022: Rescue of Celsa Spain was dependent on creditor approvals (Goldman Sachs and Deutsche Bank).

- 2023 Salzgitter support is for the firm's SALCOS project, involving investment in new electrolyser and DRI-based EAF.

- 2023: Dunaferr went into liquidation in December 2022. Some questions appear to hang over the legality of state support given by the Hungarian government, to cover wage costs in early 2023. Some press reports also question whether recent ETS-related fines of around €600m should have been waived by the Hungarian Government.

- 2023: Aid for USSK's decarbonisation project is to be provided under the European Union's Recovery and Resilience Plan.

- 2023: Condemnation arose of the aid for SIJ Group subsidiaries in Slovenia when it transpired that the parent company had approved a dividend of Euro €5.8m.

- 2023: Undertaking from the UK Government to Tata Steel was to grant up to GBP 500 million for the transition of Port Talbot in South Wales to low carbon steelmaking. Total project cost was estimated at GBP 1.25 billion.

- 2023: Discussions between the UK Government and British Steel centre on closure of Scunthorpe blast furnaces and investment in new EAF facilities at Scunthorpe and at Teesside. Talks with China's Jingye Group were still ongoing in November 2023. Unions expressed concern about the potential for 2000 job losses.

- 2021: Celsa UK support was a grant towards a static VAR compensator for the high voltage EAF in their Cardiff melt shop.

- 2024: Financial support for Vallourec related to relocation of pipe-making from Dusseldorf and Mulheim to Brazil; and was for training and redeployment of the German workforce.

Funding Agencies

Agencies involved in the above State Aid included the following.

- EU Recovery & Resilience Plan

- European Globalisation Adjustment Fund

- European Investment Bank

- European Post-Covid Recovery Fund

- Polish Government Environmental Fund

- The Spanish PERTE programme

- The UK Industrial Energy Transformation Fund

For short overview of the rules concerning public aid for the steel sector, see presentation from DG Competiiton.

Back to Knowledge Base Index

To contact us about State Aid issues please email info@steelonthenet.com.