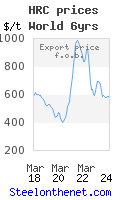

World steel prices.

Price of Steel

Recent pricing history

| Year | Month | HRC | CRC | HDG | Rebar | ||

| Please get a paid subscription to access earlier price points (from January 2008). | |||||||

| 2015 | 1 | 504 | 608 | 725 | 502 | ||

| 2015 | 2 | 475 | 606 | 714 | 492 | ||

| 2015 | 3 | 440 | 578 | 680 | 470 | ||

| 2015 | 4 | 423 | 556 | 668 | 461 | ||

| 2015 | 5 | 405 | 557 | 673 | 467 | ||

| 2015 | 6 | 400 | 541 | 663 | 472 | ||

| 2015 | 7 | 386 | 532 | 650 | 449 | ||

| 2015 | 8 | 379 | 512 | 638 | 438 | ||

| 2015 | 9 | 378 | 508 | 631 | 423 | ||

| 2015 | 10 | 352 | 493 | 616 | 404 | ||

| 2015 | 11 | 324 | 458 | 588 | 372 | ||

| 2015 | 12 | 309 | 459 | 578 | 364 | ||

| Please get a paid subscription to access more recent price info. | |||||||

Table last updated: 21st April 2024. Next update: ~ 20th May 2024.

Notes and definitions

1) World steel prices are in US dollars per metric ton. They describe average monthly global export fob prices.

2) Product definitions are as follows (for further detail, see harmonised system 6-digit codes listed below). For further clarifications on HS codes for commodity goods, visit U.N. trade statistics website.

- HRC, wide strip unpickled hot rolled sheet and coil <3mm gauge.

- CRC, cold rolled sheet 0.5-1mm thick.

- HDG, hot dip zinc galvanised coil [often also called GI, galvanised iron] width > 600mm.

- Rebar prices are for hot-rolled deformed reinforcing bar (excl rod).

3) Pricing data is compiled by MCI. It originates from an analysis of national customs statistics of larger exporting countries. Figures cover the following 6-digit codes within the harmonised tariff schedule: Hot rolled coil 720839, Cold rolled sheet and coil 720917, HDG or galvanised iron 721049, reinforcing bar 721420.

4) Note that the latest price points (the last two months in particular) for each product may change, as more current customs declarations become available from international markets.

5) Final data point normally shows steel prices per ton that are ~2 months old. This is because a short time delay is necessary for data collection.

6) Please contact us for costs of raw materials or for other product pricing data covering heavy plate, merchant bar, light sections, rod, drawn wire, carbon or stainless pipe and tube etc.

Billet & Slab Prices

Price Spreads

Steel Price History

Value Chain

Alloy Steel Prices

SUBSCRIBE

Get access to the latest steel industry news, prices and business intelligence.

Our subscriptions start from just $120 / year.

To contact us about the costs of flat or long products, please email info@steelonthenet.com.